In 1946, Fortune magazine wrote that “Joseph Di Giorgio [was] the largest grape, plum, and pear grower in the world.” Yet less than 50 years later, the Di Giorgio Corporation had ceased to exist. How did that happen?

Christine (Di Giorgio) Timmerman was Di Giorgio Corporation’s treasurer for nearly a decade during the 1980s and is the daughter of Di Giorgio Corporation CEO Robert Di Giorgio. Here she shares the story of Di Giorgio Corporation’s final days.

Although Di Giorgio Corporation was an agricultural powerhouse under founder Joseph Di Giorgio, by the mid-1960s three factors led the company to move away from its farming focus.

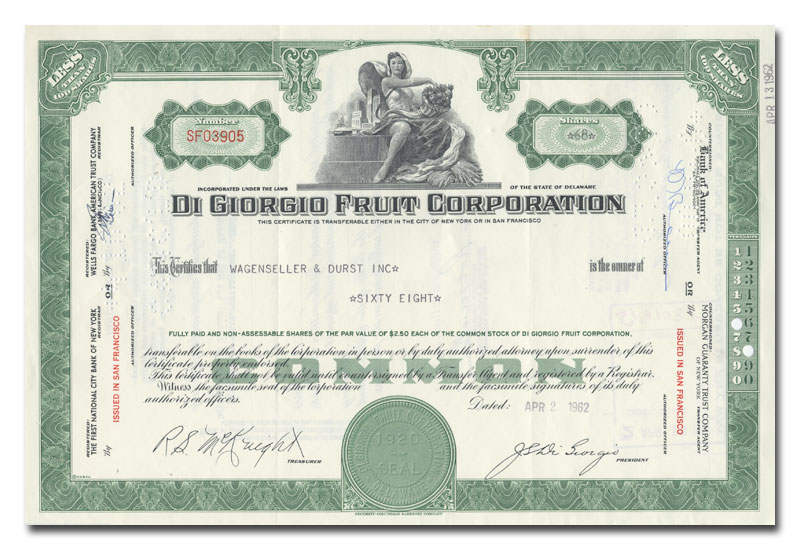

First, after Joseph’s death in 1951 Di Giorgio Corporation went public on the New York Stock Exchange in the mid 1950s. But being a public company meant having predictable earnings—and farming is a very unpredictable business. Shareholders don’t like hearing that the crops were poor, profits are down, and no dividends are forthcoming!

Since the family owned a controlling share of the firm, that meant their incomes were impacted. Management heard the shareholders and sought ways to smooth out the bumpiness of the basic farming business and improve profit reliability by diversifying the product line. The 1960s were a time of conglomerate growth, and Di Giorgio Corp. leadership felt that a diversified company would always have assets with a range of performance to smooth out earnings. Time would prove that belief to be unfounded.

Second, Caesar Chavez began his campaign for the farm labor movement in Delano. Although Di Giorgio ranches were not intensively targeted (since Di Giorgio workers were already paid at the level Chavez was campaigning for), the grape boycott hurt the company. (As a side note, when there was a labor union vote at the ranches the Di Giorgio workers voted for another union and not the United Farm Workers Union.) The poor publicity of the labor movement further inspired the management to consider diversification.

Third, federal law restricted public water usage to 360 acres. Di Giorgio’s Bakersfield ranch, which used both private wells and public water, was greatly in excess of this limit. The government chose to enforce this rule and wanted the ranch broken up.

So Di Giorgio management sold off the various ranches in Northern and Southern California, Oregon, and Washington and began buying many different enterprises. (The Florida orange groves were kept for TreeSweet). Di Giorgio fully exited the farming business in the 1970s, though it has always been associated with agriculture in the minds of many.

Numerous different companies were bought with the proceeds of the farm sales, some of which had historical ties to the company and some of which were new. But the recreational vehicle business turned sour in the 1974 gas crisis, and management disposed of that division. Also quick to come and go were patio furniture, fishing gear, peach-pitting equipment, and lumber mills.

The final companies that made up Di Giorgio Corporation into the late 1970s and 1980s were in four categories:

Food Processing

- Carando (deli meats)

- Serv-A-Portion (small portion packages)

- TreeSweet (juices)

- DG International (juices and portion packages in Europe)

Distribution

- White Rose Foods (groceries in NY area)

- LAD Drug (pharmaceuticals in the LA basin)

Building Materials

- Guaranteed Products (aluminum extrusions)

- Klamath Lumber (sawmill)

- Las Plumas (precut houseframes)

- DG Mouldings (prefinished mouldings)

- Biltbest Windows (wood windows)

Other

- DG Development (land development in Northern California and Borrego Springs)

- Travel Accessories (automotive products)

- Sun Aire (regional airline)

The late 1980s were notable for leveraged buyouts and breaking up conglomerates. Di Giorgio never had stellar profits due to the mix of companies and naturally came under the radar to be broken up to “enhance shareholder value”. Family ownership was not sufficient to ward off such interest, and the stock was very diversely held. Also by this time, leadership had passed from family to the first outsider as CEO. The firm was ripe for takeover attempts.

The company’s initial response was to sell off divisions to raise cash and reinvest in the better businesses. The corporation went from 16 companies to 8, but that was not enough and takeover interest remained. An experienced takeover individual named Arthur Goldberg made an offer to buy the company. He was interested in owning the White Rose Company, as he had a successful trucking firm in the New York area. He planned to sell off the remaining divisions to realize cash.

The company was sold to him in the spring of 1990, and that ended the Di Giorgio Corporation.

Other pages of interest

- Di Giorgio Corp. History

- DiGiorgio Corporation

- The Di Giorgios: From Fruit Merchants to Corporate Innovators

- Di Giorgio Corp. History

- DiGiorgio Corporation

- The Di Giorgios: From Fruit Merchants to Corporate Innovators

- Di Giorgio Corp. History

- DiGiorgio Corporation

- The Di Giorgios: From Fruit Merchants to Corporate Innovators